Conservation methods can help save energy and preserve natural resources, but business owners may also be intrigued by the potential cost-savings of conservation. Utility costs vary depending on the size of a business, but the U.S. Small Business Administration notes that prospective business owners must estimate and include such costs when seeking loans to start their businesses. Estimated utility costs can be intimidating, especially for those owners who have never before owned their own businesses. Traditional conservation methods like recycling and reusing are great ways to conserve and save around the office, but business owners also can embrace some other ways to lower their office energy costs while benefitting the planet at the same time.

Order an energy audit.

Many utility companies will conduct energy audits free of charge or for nominal fees. These audits typically include onsite visits, during which auditors will look for areas where business owners can conserve energy.

Determine how much space you truly need.

Current business owners and prospective owners can save substantial amounts of money and avoid wasting energy by giving ample thought to how much office space they truly need. Large office spaces may not be necessary for businesses that recently downsized staff, while those starting out may want to start in small spaces before upgrading to larger spaces if and when their businesses expand. Small business owners leasing their office space can speak with their leasing agents to determine if they can include a clause in their lease that allows them to move into larger spaces if the need arises before their existing leases expire.

Allow employees to telecommute.

Based on an analysis of data from the U.S. Census Bureau’s 2005-2014 American Community Survey conducted by GlobalWorkplaceAnalytics.com, a typical business would save $11,000 per person per year if it allowed its employees to work from home just half the time. Those cost-savings can be traced to numerous factors, and lower utility costs in the office as well as the need for less office space are among them.

Embrace green technology.

Many homeowners use programmable thermostats and other eco-friendly tech products to lower their monthly utility costs at home, and businesses can follow suit. LED lighting around the office can substantially reduce office energy consumption and costs, while business owners who own their office buildings might be able to install solar panels that will dramatically reduce energy costs and even pay for themselves over time.

Conservation is not just for home, and business owners confronted with rising energy costs can find numerous ways to lower their energy expenses while simultaneously helping the planet.

2. Don’t overlook travel agencies.

2. Don’t overlook travel agencies.

Tickets, transportation, attire, grooming treatments, meals, and several other factors can add up to make prom very costly. However, those feeling the potential stress of the prom bill can explore various ways to cut those costs.

Tickets, transportation, attire, grooming treatments, meals, and several other factors can add up to make prom very costly. However, those feeling the potential stress of the prom bill can explore various ways to cut those costs.

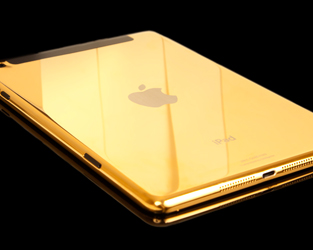

Do you like GOLD? Who doesn’t? The Franklin Shopper is hosting a Free Giveaway that will make you feel like King (or Queen!) Midas!

Do you like GOLD? Who doesn’t? The Franklin Shopper is hosting a Free Giveaway that will make you feel like King (or Queen!) Midas!